Working from home allowance (£6 per week or £26 per month)

Working from home allowance (£6 per week or £26 per month)

Please note, If you previously claimed tax relief when you worked from home because of coronavirus (COVID-19), you might no longer be eligible.

Who can claim tax relief

You can claim tax relief if you have to work from home, for example because:

- your job requires you to live far away from your office

- your employer does not have an office

Who cannot claim tax relief

You cannot claim tax relief if you choose to work from home. This includes if:

- your employment contract lets you work from home some or all of the time

- you work from home because of COVID-19

- your employer has an office, but you cannot go there sometimes because it’s full

Please visit HMRC website link for details up to date information. https://www.gov.uk/tax-relief-for-employees/working-at-home

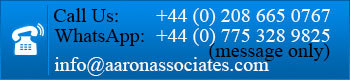

Please do not hesitate to contact us, if required. Telephone 0208 665 0767