New HMRC one-stop online shop on tax reliefs

New HMRC one-stop online shop provides taxpayers with tax relief information

HMRC has launched a new one-stop online shop designed to provide taxpayers with information on the tax reliefs and financial help available from HMRC.

In a new section of the GOV.UK website, HMRC has listed financial support available to ensure individuals are not missing out. There is guidance on relief for childcare and work-related expenses, as well as information about savings and getting help if you cannot pay your tax bill.

The shop is designed to make it easier than ever for taxpayers to claim the benefits, credits and allowances they are entitled to. HMRC has provided online guidance and tools to permit people to check if they are eligible for each relief.

Check what financial help you can get from HMRC

Child Benefit

You can claim Child Benefit if you’re responsible for bringing up a child who is:

under 16

under 20 if they stay in approved education or training

Only one person can get Child Benefit for a child.

It’s paid every 4 weeks and there’s no limit to how many children you can claim for.

Tax-Free Childcare

You can get up to £500 every 3 months (up to £2,000 a year) for each of your children to help with the costs of childcare. This goes up to £1,000 every 3 months if a child is disabled (up to £4,000 a year).

Check if you’re eligible for Tax-Free Childcare, how to apply and how to pay your childcare provider

Claim tax relief on work-related expenses

Find out how to claim tax relief on money you’ve spent on things like work uniform and clothing, tools, subscriptions, or business travel.

Claim Income Tax relief for your employment expenses (P87)

Claim Marriage Allowance

Marriage Allowance allows you to transfer 10% (£1,260) of your personal tax allowance to your husband, wife or civil partner if you earn less than the personal tax allowance, which is usually £12,570.

Find out about Marriage Allowance

Get help with savings

Get help with savings if you’re on a low income (Help to Save)

Help to Save is a savings account. If you’re entitled to Working Tax Credit or you’re receiving Universal Credit, you can get a bonus of 50p for every £1 you save over 4 years.

Child Trust Funds

A Child Trust Fund is a long-term tax-free savings account for children born between 1 September 2002 and 2 January 2011.

For those who hold an account but do not know the Child Trust Fund provider, or if you’re unsure whether you have one or not, we can help you find out.

Get help if you cannot pay your tax bill

Contact HMRC as soon as possible if you cannot pay your tax bill. We’re here to help, and you may be able to pay what you owe in instalments, depending on your circumstances and what you can afford.

Find out what to do if you cannot pay your tax bill on time

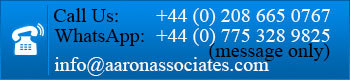

Please contact Aaron Associates on 0208 6650767