Budget 2024 Summary – Highlights

Budget 2024 Summary – Highlights

Company Car Tax Rates

- For 2028/29 and 2029/30:

- Zero-emission vehicles: 7% (2028/29), 9% (2029/30)

- Low CO2 hybrid vehicles (1-50g CO2/km): 18% (2028/29), 19% (2029/30)

- Other vehicles: increases up to 38% (2028/29) and 39% (2029/30)

Business Rates Relief

- 40% relief for RHL businesses in 2025/26, capped at £110,000 per business.

- Small business multiplier frozen in 2025/26.

- Plans for further business rates system reforms to support:

- High streets

- Investment incentives

- Fairer taxation system

Private Schools’ Charitable Rate Relief

- From April 2025, private schools in England will no longer receive charitable rate relief.

- VAT will be applied to fees for terms starting after January 2025.

Inheritance Tax (IHT)

- Nil-rate bands for IHT fixed until 2030:

- £325,000 standard nil-rate band

- £175,000 residence nil-rate band

Changes to Agricultural Property Relief (APR) and Business Property Relief (BPR)

- From April 2026:

- 100% APR/BPR relief capped at £1m for agricultural/business property

- Remaining relief at 50% for specific unlisted shares and certain assets

Inheritance Tax (IHT) on Pensions

From April 2027, inherited pensions will be subject to IHT. This change could impact those hoping to leave pensions as a tax-free inheritance for their loved ones.

National Insurance Contributions (NIC)

- Employers' NIC rate increased to 15% from April 2025.

- Employment allowance raised to £10,500 to support smaller businesses.

Capital Gains Tax (CGT)

- Increased rates from 30 October 2024:

- Lower CGT rate: 18%, higher rate: 24%

- Business asset relief rates increase to 14% (2025) and 18% (2026)

- Stamp duty adjustments on second homes and company purchases

Payrolling of Benefits-In-Kind

- Mandatory reporting of benefits through payroll from April 2026, excluding employment-related loans and accommodation.

Plastic Packaging Tax (PPT)

- New rate of £223.69 per tonne from 1 April 2025 for packaging with <30% recycled plastic.

Alcohol and Soft Drink Taxes

- Alcohol duty reduced by 1.7% for products under 8.5% ABV from 1 February 2025.

- Soft drinks levy adjusted annually for inflation from 1 April 2025.

Tobacco Duty and Vaping Products Duty

- Vaping products duty of £2.20 per 10ml starting 1 October 2026.

Air Passenger Duty (APD)

- Increases from 2026-27:

- Domestic flights: +£1

- Short-haul destinations: +£2

- Long-haul destinations: +£12

- Private jet higher rate increased by 50%

Fuel Duty and Vehicle Excise Duty (VED)

- Fuel duty rates frozen for 2025-26.

- VED adjusted to encourage EV adoption; standard rates increase for hybrids and ICE vehicles from April 2025.

Digitalization of Tax Systems (MTD ITSA)

- MTD ITSA begins in 2026 for businesses with over £50,000 turnover, extending to £30,000 turnover in 2027.

Top of Form

Bottom of Form

Double Cab Pick-Up Vehicles (DCPU) Taxation

- HMRC will classify DCPUs as cars for:

- Benefit in Kind (BIK) rules

- Capital allowances

- Business profit deductions

- Implementation dates:

- 1 April 2025 for corporation tax

- 6 April 2025 for income tax

- Transitional arrangements:

- For vehicles purchased or ordered before 6 April 2025 (BIK rules) and expenditure incurred by 1 October 2025 (capital allowances)

- VAT treatment unchanged for DCPUs with a one-tonne payload or more.

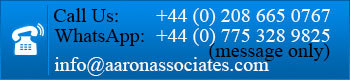

Please contact us for further information. Telephone 0208 665 0767. E-mail; info@aaronassociates.com