Quick links

- Home

- Our Services

- Financial diary

- Enquiry form

- Our specialities

- Blogs

- Business Support update - COVID-19

- THE MAKING TAX DIGITAL TIMETABLE

- VAT Flat Rate Scheme.

- Tax Free Childcare - Update

- Timescale for introducing Making Tax Digital for Business

- SPRING BUDGET 2024.

- New HMRC one-stop online shop on tax reliefs

- A summary of the Autumn Statement 2016

- Tax rebate

- TAX PLANNING AND PENSION

- Newsletter Tax Update Mid-October 2016

- AUTUMN STATEMENT – November 2023

- Making Tax Digital - Update [Nov. 2021]

- Support for businesses and employers

- Working from home allowance (£6 per week or £26 per month)

- Opportunity - offer a range of taxation services.

- 31st October Tax Return Deadline

- Publication

- Contact us

- Budget 2024 Summary – Highlights

Subscribe for Updates

Keep me updated

Contact us

Aaron Associates (UK) Limited

Registered Office: office 5

272 London Road, Wallington, Surrey, SM6 7DJ

UK Registered in England No. 5039898

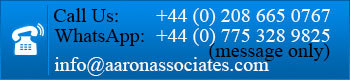

Tel: +44 (0) 208 665 0767

WhatsApp: +44 (0) 7753289825 [Message only]

E-mail: info@aaronassociates.com

Financial Diary

-

19th every month

Payment due for PAYE and NIC -

31st January

1st payment due on account of Self Assessment -

5th/6th April

Arrival of Tax Return Forms