Budget 2016-2017

RE: Budget Summary Tax Card 2016/17

Please find attached, Budget summary 2016-17. We have also listed below some of the headline changes you may find useful.

Personal Tax

- Increases in the personal tax allowance to £11,000,

- New dividend allowance of £5000, and a saving allowance of £5000.

- Property and trading income allowances. From 6 April 2017 a new £1,000 allowance for property income and a £1,000 allowance for trading income will be introduced.

- ISAs - The annual ISA allowance will be increased from April 2017 to £20,000 from the current level of £15,000.

- Lifetime ISAs. A new Lifetime Isa will be introduced for those aged under 40. Contributions will be a limited to £4,000 per annum, and these will receive a 25% bonus from the government. Contributions can be made up to the age of 50.

- Pension lifetime allowance is reduced from £1.25m to £1m for both 2016/17 and 2017/18.

Business Tax

- Profits from trading and developing UK land. From the Report Stage of the Finance Bill 2016 (probably sometime in June) all profits from trading in UK property by non-residents will be brought within the scope of UK tax.

- Corporation Tax Rates. From April 2020 the Corporation tax rate will be reduced further to 17%.

- Capital Gain Tax Rates For disposals made on or after 6 April 2016, CGT rates will be reduced to a lower rate of 10% (from 18%) and a higher rate of 20% (from 28%)

This memorandum is based on the proposals put forward by the Chancellor in his Budget speech. The details are liable to change during the passage of the Finance Bill through Parliament. Where these proposals are likely to affect a decision that you need to make you should, if possible, delay at least until the Finance Bill becomes available.

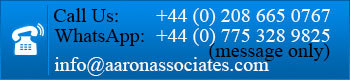

Please do not hesitate to contact us for more detailed advice and information about Budget 2016-17 and how it might affect you and your business.