5th May 2020 - Self-Employment Income Support Scheme grant - 80%.

Self-Employment Income Support Scheme grant.

The scheme will allow taxpayers / self-employed to claim a taxable grant of 80% of the average monthly trading profits, paid out in a single instalment covering 3 months, and capped at £7,500 altogether.

Pre-application stage

Emails, SMS messages and letters are being sent to taxpayers who HMRC thinks may be entitled to claim the grant. These are expected to arrive during the week beginning 4 May 2020.

Note that to guard against fraud the emails and SMS messages from HMRC do not include active links. If a taxpayer receives an email or SMS purporting to come HMRC which includes an active link, that email or SMS is a scam

Eligibility checker

The eligibility checker is available on gov.uk and is open to anyone to use, not just those who have been contacted by HMRC.

The taxpayer enters their self assessment UTR and national insurance number and the checker confirms whether they are eligible. The taxpayer does not need to enter any information about their income

How to apply

Applications will open to taxpayers on a staged basis between 13 and 18 May, with the portal opening on different days for different taxpayers. HMRC will email taxpayers who have provided an email address (when using the eligibility checker or previously) to confirm when the portal is open for them. Taxpayers can also use the eligibility checker to find out whether the application portal is open for them.

Taxpayers then log in to their government gateway account (or select the option to create an account) to complete the application process. They are presented with a detailed calculation

The taxpayer does not need to provide any information about their income – the calculations are all done by HMRC based on the tax returns submitted. HMRC expects to make payments from 25 May 2020 within six working days of the application being submitted

HMRC will be providing a telephone-based application service for the digitally excluded, further details are awaited.

HMRC has advised that agents should not use client credentials to apply for grants on behalf of clients and that doing so may trigger HMRC fraud checks and delay payment of the grant.

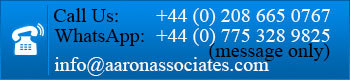

Please contact Aaron Associates on 020 8665 0767, for further help and explanation.