Making Tax Digital - Update [Nov. 2021]

Started in April 2019 with Making Tax Digital (MTD) VAT for businesses with taxable turnover above the VAT threshold. MTD VAT is extended to all businesses from April 2022 and MTD income tax self assessment (MTD ITSA) will start in April 2024.

MTD VAT is extended to all VAT-registered businesses from April 2022. MTD ITSA will start in April 2024 for the self-employed and those with income from property and in April 2025 for most partnerships. MTD corporation tax will not start until April 2026 at the earliest and is likely to be later. HMRC is also running an MTD for individuals transformation project.

The essential elements of MTD are:

- Businesses and organisations (which includes those with income from property) are required to maintain digital accounting records. Maintaining paper records ceases to meet the requirements of the tax legislation.

- Businesses and organisations are required to use a functional compatible software product to submit updates and returns to HMRC. The software uses HMRC’s API (Application Program Interfaces) platform to submit information to HMRC. The current HMRC online tax return services for the relevant tax are withdrawn when a business signs up to MTD.

Timeline for MTD

- From April 2019: MTD VAT is mandatory for VAT-registered businesses and organisations (including sole traders, partnerships, limited companies, non-UK businesses registered for UK VAT, trusts and charities) with taxable turnover above the VAT threshold. There was a six-month deferral of the start date, to 1 October 2019, for some more complex businesses.

- From April 2022: MTD VAT is mandatory for all VAT-registered businesses and organisations.

- From April 2024: MTD ITSA will be mandatory for the self-employed and those with income from property. It will only apply to those with turnover from self-employment plus gross rental income over £10,000.

- From April 2025: MTD ITSA will be mandatory for general partnerships (ie, not limited liability partnerships or partnerships with a corporate or other 'non-natural partner'). It will only apply to partnerships with a turnover of £10,000.

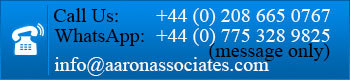

Please contact Aaron Associates on 0208 6650767