AUTUMN STATEMENT – November 2023

We have summarise the key tax announcements.

PERSONAL TAXES

Tax cuts for partners and the self-employed

From 6 April 2024:

- class 2 National Insurance Contributions (NIC) will be abolished

- class 4 NIC will be reduced from 9% to 8%.

This will reduce the tax burden on partners and the self-employed.

Class 2 NIC is currently £3.45 per week and was due to rise to £3.70 from 6 April 2024 and is payable by all those that have profits above £12,570 and are above the state pension age. This will generate a saving of £192 per year.

The reduction in Class 4 NIC will generate a tax saving of £377 per year.

Self- assessment Yax return compliance.

The government announced that individuals who only receive income that is taxed at source under PAYE will not be required to file a tax return from 2024/25. This should bring relief for up to 338,000 individuals who have simple tax affairs, even if their income exceeds £150,000.

However, it’s important to remember that the savings and dividend allowances were reduced, bringing more people into self-assessment unless the additional tax is fully collected via adjustments to their PAYE tax code. Other criteria for filing a return, including being self-employed or a partner in a partnership, renting property and receiving income from abroad will remain in place.

Annual Tax on Enveloped Dwellings

The ATED charge will increase in line with inflation by 6.7% from April 2024. This will take the charge to £4,400 a year for a property valued between £500,001 to £1m, and at the top end of the scale to £287,500 a year for a property valued over £20m (up from £267,450, being an increase of over £18,000).

Residential landlords – Making Tax Digital for income tax is coming from April 2026

Making Tax Digital (MTD) is to be introduced for income tax from April 2026. This will impact landlords holding property in their own name.

Landlords with annual income of £50,000 will be required to join and operate MTD for income tax from April 2026. Electronic quarterly submissions will be required.

The £50,000 threshold is expected to be reduced to £30,000 from April 2027, although the government is keeping this reduced threshold under review.

It has been recognised that those landlords who hold property jointly may not always have access to their expense records regularly so landlords in that position are able to choose not to submit the expenses quarterly but instead provide the expense figures annually.

Inheritance Tax and Capital Gains Tax

The Autumn Statement was silent on any changes to Capital Gains Tax (CGT) and in particular possible abolition of Inheritance Tax (IHT).

CGT rates are currently relatively low and only 10% on any gains on the sale of business assets up to a lifetime limit of £1 million per person.

Reduced employee rate of National Insurance

The Chancellor has cut employee National Insurance rates on income between £12,570 and £50,270 from 12% to 10%. This is effective from 6 January 2024.

This change is said to benefit 27 million employed workers. Someone on an average salary will save £450 per year, or for higher earners up to £754.

Overall, it seems all adults will be slightly better off, but not by much.

What about non-doms?

After much speculation that changes were on the horizon for the non-domicile regime, there was no mention of it in the Chancellor’s Statement.

Structural pension industry changes announced that will impact Trustees and employers

Pension Funds

Surpluses

- Consultation on the repayment of surpluses. The surplus payments charge will be reduced from 35% to 25% from 6 April 2024.

Consolidation

- Plans to consolidate DC and local authority schemes into larger schemes.

- Consultation on how the Pension Protection Fund will be opened to certain smaller DB schemes.

- Reforms for authorised consolidators relating to small pension pots.

Lifetime provider

- A call for evidence on employees having the legal right to have their pension contributions paid into their existing pension arrangements.

Master Trusts

- A review of the Master Trusts market will be published.

DC arrangements

- Proposals for duties in relation to decumulation.

- A consultation on a new value for money framework.

Employers

- Guidance on what factors should be assessed when selecting a pension scheme, including both fee and performance considerations.

Trustees

- A register of Trustees to aid engagement with Trustees and to update the Trustee toolkit.

Lifetime Allowance (LTA)

- Legislation will be put in place to remove the LTA from 6 April 2024 and therefore the related tax charges.

Good news for employees.

The headline, is the reduction from 12% to 10% in the rate of employee class 1 National Insurance Contributions (NICs).

Employee NIC changes will put more money in employees’ pockets from January 2024 and therefore help employers manage related inflationary pressures on their pay bill.

Employees will generally welcome the measures announced. More money in pockets and simplicity are of course attractive. Employers will need to manage the short and longer-term transitions and keep an eye on how they add to administrative complexity and risk.

Two Research and Development tax credit schemes merged

The UK will merge its two research and development (R&D) tax credit schemes from 1 April 2024. The national tax rate restriction for loss making companies will decrease from 25% to 19%.

The intensity threshold for R&D intensive small and medium-sized enterprises (SMEs), will reduce from 40% to 30% and companies will have a year of grace to continue to be treated as R&D intensive if they drop below the 30% threshold.

Companies claiming R&D tax reliefs face uncertainty about how HMRC will apply it's own guidance on what it determines a qualifying project.

Capital Allowances

100% full expensing (main rate pool) and 50% First Year Allowance (FYA, special rate pool) for qualifying plant and machinery has been made ‘permanent’ (originally a temporary measure for expenditure incurred on qualifying plant and machinery between 1 April 2023 and 31 March 2026).

The change makes permanent relief available for qualifying capital expenditure on plant and machinery in the year the expenditure is incurred. The Chancellor announced that “the change provides one of the most generous capital allowance provision in the world”.

For qualifying expenditure incurred on or after 1 April 2023, companies can claim:

- a 100% FYA for main rate expenditure – known as full expensing

- a 50% FYA for special rate expenditure.

Full expensing will be available for expenditure on new qualifying plant and machinery, however some expenditure will not qualify for FYAs.

Consideration should be made around future plans on disposal of plant and machinery as special disposal rules apply after claiming full expensing, and standard pooling and AIA may be an option.

While second hand property acquisitions do not apply, new construction, refurbishment and fit-out expenditure may qualify for full expensing. On property disposals where qualifying plant and machinery fixtures have been full expensed, it is important to receive the correct advice to consider the use of the CAA01/s198 election provisions to prevent balancing charges.

LLPs and partnerships do not benefit from the full expensing, but corporate members will be able to claim it, if appropriate. LLPs and partnerships without corporate members can continue to claim the AIA.

INDIRECT TAX

VAT Treatment of Private Hire Vehicles

Following the previous Uber judgments, and Uber was asking the High Court to apply the same principles elsewhere.

There is a significant VAT impact associated with this, meaning that many operators who act as agents on behalf of (mostly) non-registered drivers would be liable to pay VAT on all the sums paid by the customer. This may in turn lead to price increases for consumers.

The government has now announced that it will consult on the impact of this judgment in early 2024.

Zero rating

The government announced extensions to the zero rate of VAT.

Women’s Sanitary Products

The current zero-rated relief on women’s sanitary products will be extended to include reusable period underwear from 1 January 2024.

Relief for energy saving materials extended

There was little mention of VAT with minor extensions to the scope of zero rating. HMRC are expanding the scope for energy saving materials to include additional technologies such as water-source heat pumps. It also brings buildings used solely for a relevant charitable purpose within scope of the relief. This relief will apply from 1 February 2024, but is due to increase to the reduced rate of 5% from 1 April 2027, so is relatively short-lived.

The extension for energy saving materials will impact charities and homeowners installing these additional technologies.

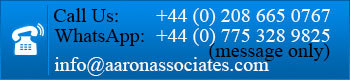

Please contact us on 020 8665 0767 for details.