CORONAVIRUS JOB RETENTION SCHEME – !st April 2020

Frequently Asked Questions

Q1: Which employees can we claim?

Furloughed employees must have been on your PAYE payroll on 28 February 2020, and can be on any type of contract, including:

- full-time employees

- part-time employees

- employees on agency contracts

- employees on fexible or zero-hour contracts

The scheme also covers employees who were made redundant since 28 February 2020, if they are rehired by their employer.

Furlough employee can not undertake work for or on behalf of the organisation. This includes providing services or generating revenue. The employefi’s wage will be subject to usual income tax and other deductions.

Employers should discuss with their staff and make any changes to the employment contract by agreement.

To be eligible for the subsidy, employers should write to their employee conriming that they have been furloughed and keep a record of this communication.

Q2: Which employees are not eligible?

Employees hired after 28 February 2020 cannot be furloughed or claimed for in accordance with this scheme.

If an employee is working, but on reduced hours, or for reduced pay, they will not be eligible for this scheme and you will have to continue paying the employee through your payroll and pay their salary subject to the terms of the employment contract you agreed.

Q3: What if employees are on unpaid leave?

Employees on unpaid leave cannot be furloughed, unless they were placed on unpaid leave after 28 February.

Q4: What about employees on Statutory Sick Pay?

Employees on sick leave or self-isolating should get Statutory Sick Pay, but can be furloughed after this.

Employees who are shielding in line with public health guidance can be placed on furlough.

Q5: What if an employee has more than one job?

If your employee has more than one employer they can be furloughed for each job. Each job is separate, and the cap applies to each employer individually.

Q6: What if an employee does volunteer work or training?

A furloughed employee can take part in volunteer work or training, as long as it does not provide services to or generate revenue for, or on behalf of your organisation.

Q7: What if an employee is on Maternity Leave, contractual adoption pay, paternity pay or shared parental pay?

Individuals who are on or plan to take Maternity Leave must take at least 2 weeks of work (4 weeks if they work in a factory or workshop) immediately following the birth of their baby. This is

a health and safety requirement. In practice, most women start their Maternity Leave before they give birth.

If your employee is eligible for Statutory Maternity Pay (SMP) or Maternity Allowance, the normal rules apply, and they are entitled to claim up to 39 weeks of statutory pay or allowance.

Employees who qualify for SMP, will still be eligible for 90% of their average weekly earnings in the first 6 weeks, followed by 33 weeks of pay paid at 90% of their average weekly earnings or the statutory flat rate (whichever is lower). The statutory flat rate is currently £148.68 a week, rising to £151.20 a week from April 2020.

If you offer enhanced (earnings related) contractual pay to women on Maternity Leave, this is included as wage costs that you can claim through the scheme. The same principles apply where your employee qualifes for contractual adoption, paternity or shared parental pay.

Q8: How much can we claim?

Employers need to make a claim for wage costs through this scheme. You will receive a grant from HMRC to cover the lower of 80% of an employee’s regular wage or £2,500 per month, plus the associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on that subsidised wage. Fees, commission and bonuses should not be included.

At a minimum, employers must pay their employee the lower of 80% of their regular wage or £2,500 per month. An employer can also choose to top up an employee’s salary beyond this but is not obliged to under this scheme.

HMRC will issue more guidance on how employers should calculate their claims for Employer National Insurance Contributions and minimum automatic enrolment employer pension contributions, before the scheme becomes live.

For full time and part time salaried employees, the employee’s actual salary before tax, as of 28 February should be used to calculate the 80%. Fees, commission and bonuses should not be included.

Q9: What About Employees whose pay varies?

If the employee has been employed (or engaged by an employment business) for a full twelve months prior to the claim, you can claim for the higher of either: the same month’s earning from the previous year average monthly earnings from the 2019-20 tax year. If the employee has been employed for less than a year, you can claim for an average of their monthly earnings since they started work.

If the employee only started in February 2020, use a pro-rata for their earnings so far to claim.

Once you’ve worked out how much of an employee’s salary you can claim for, you must then work

out the amount of Employer National Insurance Contributions and minimum automatic

enrolment employer pension contributions you are entitled to claim.

Q10: What about National Insurance and Pension Contributions?

All employers remain liable for associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on behalf of their furloughed employees.

You can claim a grant from HMRC to cover wages for a furloughed employee, equal to the lower of 80% of an employee’s regular salary or £2,500 per month, plus the associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on paying those wages.

You can choose to provide top-up salary in addition to the grant. Employer National Insurance Contributions and automatic enrolment contribution on any additional top-up salary will not be funded through this scheme. Nor will any voluntary automatic enrolment contributions above the minimum mandatory employer contribution of 3% of income above the lower limit of qualifying earnings (which is £512 per month until 5th April and will be £520 per month from 6th April 2020 onwards).

Q11: What about employees on National Minimum Wage?

Individuals are only entitled to the National Living Wage (NLW)/National Minimum Wage (NMW) for the hours they are working.

Therefore, furloughed workers, who are not working, must be paid the lower of 80% of their salary, or £2,500 even if, based on their usual working hours, this would be below NLW/NMW.

However, if workers are required to for example, complete online training courses whilst they are furloughed, then they must be paid at least the NLW/NMW for the time spent training, even if this is more than the 80% of their wage that will be subsidised.

Q12: What information is required to make a claim?

To claim, you will need:

- your PAYE reference number

- the number of employees being furloughed the claim period (start and end date)

- amount claimed (per the minimum length of furloughing of 3 weeks)

- your bank account number and sort code

- your contact name

- your phone number

You will need to calculate the amount you are claiming. HMRC will retain the right to retrospectively audit all aspects of your claim.

You can only submit one claim at least every 3 weeks, which is the minimum length an employee can be furloughed for. Claims can be backdated until the 1 March if applicable.

Q13: When can we start claiming?

The online service you’ll use to claim is not available yet. We expect it to be available by the end of April 2020.

You can only submit one claim at least every 3 weeks, which is the minimum length an employee can be furloughed for. Claims can be backdated until the 1 March if applicable.

Q14: How will the grant be paid?

Once HMRC have received your claim and you are eligible for the grant, they will pay it via BACS payment to a UK bank account.

You should make your claim in accordance with actual payroll amounts at the point at which you run your payroll or in advance of an imminent payroll.

You must pay the employee all the grant you receive for their gross pay, no fees can be charged from the money that is granted. You can choose to top up the employee’s salary, but you do not have to.

Q14: What happens when the government ends the scheme?

When the government ends the scheme, employers must make a decision, depending on their circumstances, as to whether employees can return to their duties. If not, it may be necessary to consider termination of employment (redundancy).

Once the scheme has been closed by the government, HMRC will continue to process remaining claims before terminating the scheme.

Q15: What about employment rights of furloughed employees?

Employees that have been furloughed have the same rights as they did previously. That includes Statutory Sick Pay entitlement, maternity rights, other parental rights, rights against unfair dismissal and to redundancy payments.

Q16: What about Income tax, NIC and pension deductions?

Wages of furloughed employees will be subject to Income Tax and National Insurance as usual. Employees will also pay automatic enrolment contributions on qualifying earnings, unless they have chosen to opt-out or to cease saving into a workplace pension scheme.

Employers will be liable to pay Employer National Insurance contributions on wages paid, as well as automatic enrolment contributions on qualifying earnings unless an employee has opted out or has ceased saving into a workplace pension scheme.

Q17: Is the Coronavirus Job Retention Grant Taxable?

Yes, payments received by a business under the scheme are made to offset these deductible revenue costs. They must therefore be included as income in the business’s calculation of its taxable profts for Income Tax and Corporation Tax purposes, in accordance with normal principles.

Businesses can deduct employment costs as normal when calculating taxable profits for Income Tax and Corporation Tax purposes.

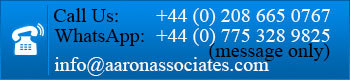

Please do not hesitate to ring Aaron Associates (UK) Limited on 0208 665 0767, for further clarification.